PIPE Investment into Gold Mining

The expression ‘all that glitters is not gold’ can be applied to everything but gold, or can it…

As we write this (Sep’20), the price of gold is hovering around $2,000/oz, or +/-$600 more than the 2019 average; as you read this, it is more like:

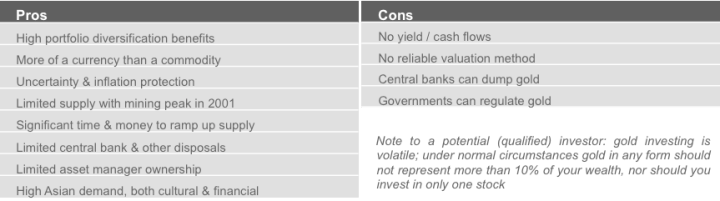

Is there still, was there ever an opportunity? Yes, we think so. Owning physical GOLD is definitely more tangible than owning digital or even fiat currency, yet it is probably not more intuitive to most, or at least those born after 1990 or even 1970.

Gold Basics (are / were)

Or in simpler terms:

Gold Context

Over the past 45 years, gold has outperformed the world’s ‘most useful’ commodity (oil) and dwarfed the world’s ‘safest currency’ (Swiss franc):

- Every single currency in history, without exception, has eventually fallen against gold- because unlike printing money, gold quantities cannot be expanded to meet the spending needs

- But even more attractively, gold outdid commodities with much more apparent application in today’s economies, such as the main energy commodity(crisis, demand, alternatives,..)

- Indexed prices:

Indexed to 1976 prices of US$ per OZ, BBL or CFH respectively

Just a couple of years ago there was a wide analyst consensus that $1,200/oz was the new floor price below which many mines would need to shut down, so coupled with ‘no real inflation’ it should translate into profitable mines at today’s prices.

On the other hand, as the price of gold is also inversely correlated to the US$ which has been decreasing significantly over the past period, maybe gold ounces will be worth less again… or maybe not judging by the US national debt it would seem a highly unlikely affair (just check for example the US National Debt).

Gold Drivers

Now the drivers of gold value have been around for a while now, and we have it on good authority that they will finally catch on:

Resilience & store of value: for the foreseeable future gold remains the only refuge & universal money

- Today gold represents a minuscule share of global financial assets (+/-½%) so any shifts in asset manager allocations could result in large swings in gold price

No counterparty risk: at a time of the most reckless monetary experiment in the history of mankind (mostly holds for physical gold, less so for gold ETFs or mining concessions)

- Looming fiscal crisis coupled with deflationary pressures will eventually be replaced with high (hyper) inflation

- Gold could well be the only (tangible) investment instrument to remove wealth from the financial system, effectively shorting the government

Asian demand / China: Western democracies have a vested interest in diminishing gold’s appeal, as they expand their fiat currencies, but the East is not buying it

- Chinese net imports of gold through Hong Kong alone, have grown six-fold in the period 2011-15 (3 years after the last crisis), amassing on average 100 tons per month

- Could a Shanghai Gold Fix replace the ‘phoney’ London Gold Fix where the miners settle the price against their output?

Gold supply & demand are non-correlated with its price: the annual supply of gold, and for that matter demand, has little to do with the gold price

- Total gold stock remains (for ages) under 200,000 tons vs. annual production of +/-3,000 tons depending on the period

Source: Shayne McGuire, Hard Money, 2010

Gold Investing

- Investors buying gold, whether physical (coin, bar) or paper (exchange traded funds) or operational (mining stock), are in a way speculating that its value will increase (i.e. that its value will conserve while other assets fall)

- Here we are not entertaining a gold price increase for appreciation, but rather saying that there are potentially great assets in the current market, whereby an informed investment risk decision could result in superior returns

- The most basic way to outperform the price of gold, when things are volatile or are going up, is by investing in equity-related gold mining stock, achieving leverage on the bullion through the future production (i.e. PIPE Investment into Gold Mining)

- So targeting relatively advanced exploration junior miners with good teams and above average gold assets – trading in an industry where the product does not become technologically obsolete or has no expiry date

- Finite mine reserves create a continual requirement for producers to add new reserves to their portfolios, and as such guarantee repeated M&A activity (see some of the typical buyers in the Stock Ticker below), or exit optionality for juniors even if they do not go into production

- Despite the hardships of assigning absolute value to an ounce of gold, there are simple indicators of valuing mining stocks relative to their market peers and in light of their underlying mineral assets

- Loading..

Gold Valuation

Three generally accepted valuation approaches:

- Income approach – based on the principle of anticipation of benefits (usually DCF)

- Cost approach – based on the principle of contribution to operational cash flows

- Market approach – based on the principle of substitution (market comparables)

A typical valuation approach depends on the stage of exploration or development of the property:

- We suggest, the market approach to be used to identify the assets, and then a mix of other techniques to confirm viability

Over the last dozen years, market comparables would suggest the following global averages (y-axis multiple ranging between 40 and 120 $/oz):

Some Mining Lingo

Reserves and resources:

[CIM, JORC & SAMREC Reserve Classifications Referenced]

- Mineral Resource – a mineral deposit for which quantity (tones) and quality (grade) can be estimated, but not yet demonstrated to be economic

- Measured – highest confidence category

- Indicated

- Inferred – lowest confidence category

- Mineral Reserve – that part of the mineral resource that can be extracted economically

- Proven – higher confidence category

- Probable – lower confidence category

- Please note that not all the ounces are equal by other criteria as well

- Geographic location

- Open / closed pit

- Existing infrastructure

- etc.

Mining Lifecycle

Stick to Evaluation, Development & Production (✔ phases 2 & 3):

- Exploration ✖

- Generative stage: Public geoscientific information- including a range of detailed pre-competitive geophysical data such as magnetic, radiometric and contour maps, images and survey data of the general area, as well as historical exploration data supplemented with private reconnaissance field work including prospecting, mapping and geochemical sampling activities. With the survey material, analysis of the properties of other established deposits and an understanding of the earth’s physical and chemical processes, an exploration model is developed to guide more detailed exploration activity. Activity at this stage is primarily supported by the in-house team.

- Primary exploration stage: In this stage (pending relevant licenses and approvals), the targeted area is subjected to exploratory drilling or trenching to delineate likely zones of mineralisation. If a potentially viable deposit is discovered, more intensive sampling and geochemical analysis is conducted in order to fully map and define its size, grade and geometry. This may involve intensive drilling, trenching or underground sampling. An exploration shaft, decline or adit may be excavated to gain underground access to the deposit. Activities at this stage are supported by professional expertise in safety and risk management, community and environmental management and project, information and financial management.

- Exploration & EIS ✔

- Evaluation stage: The stage is to determine whether it is economically viable to develop the mine- including comprehensive technical and socio-economic analysis to determine whether or not mining is economically feasible. It includes engineering operational factors such as mine design, infrastructure availability, assessments of environmental impacts and stakeholder issues, and detailed financial analysis of costs and revenue projections with market assessment. Study activity is broken into three categories: (i) scoping; (ii) preliminary feasibility; and (iii) feasibility & EIS studies are supported by external teams, and all government-related permits are obtained for the full life cycle of the mine

- Development & Production (post-exploration) ✔

- Development stage: Mine pre-construction and construction work commences after all necessary permits and approvals have been obtained. Steps include removing old buildings, developing infrastructure and building camps for workers if there is insufficient availability of local accommodation (mines can grow large enough to support towns, with schools, medical facilities and recreation areas). Mine construction generally takes a few years, depending on the mine location, complexity and regulatory requirements, and can be (i) open pit (surface); (ii) closed pit (underground); or (iii) hybrid. Significant environmental requirements apply at this stage in relation to the management of flora, fauna, topsoil and water quality, and the prevention of erosion. EPC contract is awarded in a open or targeted tender.

- Production stage: The mine operation includes controlled blasting, hauling, crushing, leaching, processing and beneficiation for the recovery of the metal. The process varies depending on the individual mineral and mine. The production is handled by a professional junior/senior miner and the explorer/developer becomes only a part of the supervisory//monitoring process.

- Rehabilitation (post-production) ✖

- Rehabilitation stage: Mine closure and rehabilitation comes once the reserve has been exhausted or economic excavation is no longer possible. The intent is to leave the land in a stable situation which will not excessively impact more of the environment. This stage works to return the land to the traditional owners and as habitat for flora and fauna. Infrastructure not requested to remain in place by traditional owners or government will be removed for sale or disposal. After the work has been done, monitoring and evaluation is done for a number of years (as specified by the relevant documents signed with governments and municipal authorities), until the mine and the liability is handed back in a final lease relinquishment, with any monetary security deposits being paid back.

Photo:M.Umarova

Investment Strategy

Gold industry company numbers (standards) differ as well as their lifecycle stages, so one needs to find a comparable metric, and according to John Doody, A Master Class on Gold Stock Investing, 2014 the best one seems to be the Market Cap per ounce in view of its Operating Cash Flow:

- Taking the universe of TSX stocks (minus the outliers) one can get the average price per ounce of production or price per ounce of reserve

- So for example at the time of the above publishing, an average ounce of reserves was valued at $48/oz, while an average ounce of production was valued at upto 30-times more, $1,530/oz

- Hence the large expected valuation gain when the mineral reserves go through full feasibility to development, and finally to production

Since we are suggesting targeting ‘advanced juniors’, we should be looking primarily at the reported reserves as the only real indicator

- Reserves represent future production that’s still in the ground, and is yet to be fully studied or mined

- Stock exchange regulation allows reserve reports only through proven and probable ounces

- Key is the drill spacing for a fair degree of confidence of the ounces in between

- Some geologies are consistent in gold grading, in others’ mineralization is irregular

- In any case it is always an educated best guess until a mine is actually fully dug out

Operating cash flow: this is the gold price minus the bare cost of getting those ounces out of the ground – labor, material, explosives, steel, etc.

- Relatively early in the mining lifecycle, one would treat the mines as though they are in production, in the African context

- Using a fairly good pre-feasibility of a known geology or a full JORC compliant feasibility study, one can determine to some precision what it is going to cost to mine the ounces from the ground and what the capital cost are going to be

- In 2014, an average company was selling at 5.9-times (Enterprise Value to) operating cash flow

As we write this in September 2020, the indicators would seem to be similar to those of 2014, although the price of gold is significantly up – a mess (and opportunity) induced by the Corona crisis…

So we are not suggesting that you hoard cases of physical gold in your basement, although it may not be a bad idea if there ever is a ‘bank run’, but rather owning significant chunks of mining stocks at various stages of development… i.e. doing private equity like transactions on traded mining (developer) stocks: PIPE Investment into Gold Mining

PIPEs

Private Investment in Public Equity (PIPE) is when a publicly traded company sells its stock to investors in a privately negotiated transaction

- Private allocation of shares, but not through a public offering in a stock exchange

- Part of the primary market with delayed registry, or a bridge to a public offering

Regulated PIPE transactions need to satisfy a number of criteria

- Qualified accredited investor is the buyer of the security

- Fundraising does not undergo general public solicitation

- Private PIPE issue is limited in offering size (% ownership)

Typically for small cap stock with poorer access to capital

- Relatively cheap, without expensive roadshows and banking fees

- Limited materials and due diligence due to public nature of the stock

- Expanded qualified shareholder base for stability and credibility

- Less regulatory issues with the securities regulator

-

- Resale registration statement is usually filed only after transaction

- Transaction is not disclosed to public until commitments received

PIPE financings (ranging from $5-100mil) are tailored for a particular company’s capital structure and financing needs (including growth capital, acquisition financing, recapitalisations and secondary equity sales); typically there are two main types of regulated instruments:

- Traditional: common or preferred shares, issued at a set price (at a discount to the current market value – up to 10%, or downside protection if issued as unregistered stock – up to 6 month restriction)

- Structured: convertible debt (to common or preferred shares), or structures including share warrants as sweeteners (such as caps, floors, mandatory redemptions and trading restrictions)

PIPE is a hybrid instrument often pursuing a block investment strategy

- Generally used by investors who aim to play a constructive, active role in unlocking value from public companies

- Through the implementation of financial, operational and governance initiatives from minority positions

- In a way this resembles minority private equity investing (board representation and certain blocking rights, but not full active lead), yet potentially with a shorter-term view

Existing company shareholders tend to have mixed reactions to PIPEs as it is often highly dilutive to the existing shareholder base

- In many instances the regulation will give preemptive rights to existing shareholders and preferences for rights issues

- This allows existing shareholders an opportunity to invest before the company seeks outside capital

With a market capitalisation of over CAD 3 trillion and over 3,000 companies listed, the ‘joint’ Toronto Stock Exchange is one of the largest stock exchanges in the world

- TSX is the mainstream exchange & TSXV is the venture exchange- including many of the mining juniors (920 of 1,650 listings or CAD33bil of CAD58bil) – jointly more than 1,200 miners listed! (Source: The MiG Report, TSX and TSXV, JULY 2020)

- TSX alone has the greatest number of security listings of any exchange in North America and has the second-most listings worldwide & has the eighth largest exchange in the world by market capitalisation

A key bourse for mining industry with significant numbers of junior miners cash-strapped

- Quite a few teams and African gold assets which are relatively advanced in the mining lifecycle

- There is no benefit to the company’s growth prospects when a secondary stock purchase is made (a pure stock purchase), therefore this market is ripe for PIPE transactions

Advantage over PE:

- Listed (transparent) companies with history & management, and inherent liquidity of the stock market but with mineral upside potential

TSX PIPEs are subject to Canada’s provincial securities laws as well as stock exchange rules

- A PIPE will be completed under an exemption from the prospectus and registration requirements

- Investor will generally be subject to a four-month restriction on resale

- Shareholder approval may be required if the structure of the PIPE transaction would result in significant dilution to existing shareholders or pricing below permitted discounts

- Relief is found under TSX Financial Hardship Exemption in the current market environment if there is serious financial difficulty:

- the company is in serious financial difficulty (many of the junior assets are in today’s market)

- the proposed transaction has been designed to improve the financial position of the corporation

- the transaction is reasonable in the circumstances – however this will require more review from TSX

- Relief is found under TSX Financial Hardship Exemption in the current market environment if there is serious financial difficulty:

Image:G.Fejic

The foregoing dry section was based on SEC, TSX, Investipedia & Wiki text extracts; now you deserve a pause & a drink (or a pipe smoke)…

Gold is at the heart of this Theme Vitrine , with PIPEs making the investment easier & Africa making it cheaper… To read more about PIPE Investment into Gold Mining please continue click on to Why Africa?:

Theme Related Tracker

- Will The ECB Continue To Hike Rates?on June 15, 2023

We expect the ECB to deliver a 25bp rate hike this week and signal more to come. Rates markets are already priced for this outcome, and softening economic data dents the ECB's ability to push rates above their 2023 top. The impact on EUR/USD may be short-lived, with dollar rates still likely to be the primary driver of any sustained trend in the pair. When the European Central Bank governing council meets this week, no one will be shocked to discover that it elected to raise its policy rates by another 25bp. Our colleagues think the bank won’t…

- Forbes: Aramco Remains Largest Company In The Middle Easton June 15, 2023

Aramco is the biggest company in the Middle East in terms of sales, revenues, and market value, according to the latest Forbes list for the top 100 companies in the region. With a market value of $2.1 trillion and sales of $604.4 billion, Aramco was an unsurprising winner of the top spot, with another 32 Saudi companies also on the top 100 list. This made Saudi Arabia the most represented country on the Forbes list. Those also include SABIC, the industrial conglomerate, and Ma’aden, the Saudi state mining company. SABIC ranked at…

- Caltech Scientists Succesfully Beam Back Solar Power From Spaceon June 13, 2023

Engineers at the California Institute of Technology (Caltech) have achieved a major breakthrough in the ongoing development of space-based solar power. The university recently reported that its experimental Space Solar Power Demonstrator (SSPD-1) successfully beamed solar power from space back down to Earth in a historic first which could spark major interest in what many think is the next frontier in clean energy production. It’s become increasingly clear that one of the biggest hurdles for scaling solar and wind power is…

- Could Crypto Overtake Traditional Investment?on May 9, 2022

Despite recent volatility, there is rising conviction that cryptocurrency is on track not just to continue to enter the mainstream with increased momentum–but some predict it will surpass traditional investing within a decade. A new survey by crypto exchange service Bitstamp of 28,000 investors worldwide finds that the majority see crypto going fully mainstream in the next 10 years. Some 88% of institutional and 75% of retail investors surveyed believe that crypto will undergo mainstream adoption in a decade. A further 80% of…

- Americans Still Quitting Jobs At Record Paceon May 4, 2022

March with the gap between open jobs and available workers reaching 5.6 million. The Labor Department reported in its Job Openings and Labor Turnover Survey for March, 4.5 million Americans, or about 3% of the nation’s workforce, quit their jobs in favor of better wages and working conditions. During the same period, the number of job openings rose to 11.5 million, an increase of 152,000 from the previous month. Economists were looking for job openings to decline to 11.2 million in March. The job openings significantly increased among…

- FinTech Startups Tapping VC Money for ‘Immigrant Banking’on May 2, 2022

Altruism is not the very first thing that comes to mind when the banking sector is considered, but a new generation of fintech companies is hoping to change that to some extent by tweaking offerings to be either “green” or socially equitable, such as offering avenues to credit for immigrants and harnessing an almost entirely untapped market. The fintech industry is rapidly growing and the global industry is projected to reach a valuation of $310 billion in 2022 growing at 25% CAGR. The number of fintech startups worldwide tripled…

- Mortgage and refinance interest rates today, March 8, 2026: Just below 6% (at 5.98%)on March 8, 2026

- Best high-yield savings interest rates today, March 8, 2026 (Earn up to 4% APY)on March 8, 2026

- Best CD rates today, March 8, 2026 (lock in up to 4% APY)on March 8, 2026

- Best money market account rates today, March 8, 2026 (best account provides 4.01% APY)on March 8, 2026

- HELOC and home equity loan rates Sunday, March 8, 2026: Seasonal demand growson March 8, 2026

- From Crypto to Private Credit, Alts Attract Millennials Flush with Inherited Wealthon March 8, 2026